8 mins read

5 mins read

AHMAD AL ABID

November 23, 2023

In the ever-expanding world of eCommerce, the ability to ship products globally is a game-changer for Canadian business owners.

However, navigating the complexities of international shipping, particularly the customs declaration process, can be a daunting task.

In this guide, we will explore the crucial aspects of correctly filling out a customs form for international shipping, providing valuable insights and practical tips for eCommerce store business owners in Canada. Let's dive in!

Before we get into the nitty-gritty details, let's understand the fundamental purpose of the customs declaration process. Customs forms serve as a bridge between countries, facilitating the smooth flow of goods across borders.

Customs forms provide essential information about the contents of a package, helping customs authorities assess duties, taxes, and ensuring compliance with regulations.

Get these forms right, and your eCommerce business can get access to markets all around the world.

Here is your customs form checklist, so you have everything you need to fill out your customs declaration:

Having all this information handy makes filling out the forms SO much easier. But remember, accuracy is key when it comes to customs formalities.

You can often include this info on your commercial invoice, shipping label, or a specific customs document, depending on your courier service and the type of mail you’re sending.

Just a heads-up, though: each country has its own set of rules for international shipping, so it's wise to stay informed about these variations and research beforehand whether it be the UK, US or UAE, you are sending to.

As a Canadian eCommerce business, it’s likely you’re planning to tap into the large market just south of the border.

However, the U.S. Customs and Border Protection Agency has specific requirements that demand careful attention if you want to get your products across the border. Check out our full resource here to get started.

You will want to ensure you are well-versed in the necessary international shipping documentation.

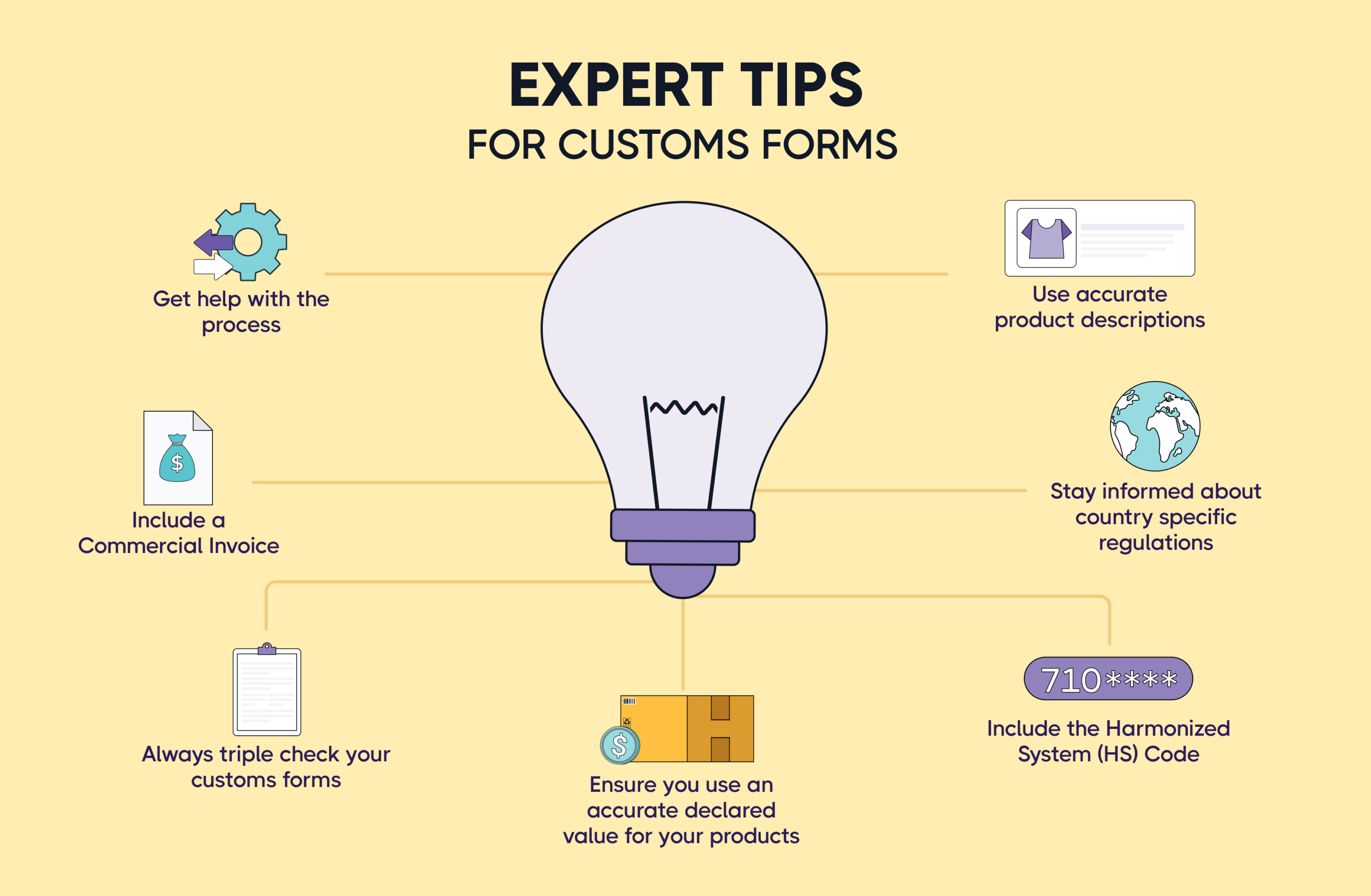

Here are a few tips to ensure a smooth international shipping process for your goods.

One of the most common mistakes in filling out customs forms is providing vague or inaccurate product descriptions. Be specific and detailed about each item, including its quantity, value, and purpose.

For example, let's take the case of shipping a batch of clothing items to a customer in the United States. Instead of a generic entry like "clothing," a well-done product description might read: "Three high-quality cotton T-shirts in assorted colours – 100% pre-shrunk cotton, short-sleeved, round neck, men's size medium."

This level of specificity not only aids customs authorities in accurately assessing duties and taxes but also ensures that your customer receives exactly what they ordered.

The Harmonized System code is a standardized numerical method used globally to classify products. Each product has a specific code that aids customs authorities in accurately assessing duties and taxes. Make sure to include the correct HS code for each item in your shipment.

Accurately declaring the value of your goods is crucial for customs assessment. Avoid undervaluing items to save on taxes, as this can lead to penalties and delays. Include the cost of the product, shipping, and any additional charges to provide a comprehensive declared value.

Suppose you are sending a smartphone with a declared value of $50 when its actual market value is $500. While this might seem like a way to minimize customs duties, it can trigger a series of issues. Customs authorities may question and flag the discrepancy between the declared value and the actual worth of the item, leading to delays and potential penalties for providing inaccurate information. You don’t want to be on the bad side of the customs authorities, anywhere in the world.

To avoid costly errors, triple-check all the information on your customs form. Ensure that names, addresses, and product details are accurate and match the information provided in other shipping documents.

Different countries have varying regulations and restrictions on imported goods. Stay informed about the specific requirements of the destination country to prevent customs-related issues.

Some products may be prohibited or subject to additional scrutiny, so research and comply with these regulations. Understanding customs documentation for different countries ensures you provide all the correct information.

A commercial invoice is a crucial component of the customs international shipping documentation. It provides a detailed breakdown of the transaction, including the buyer and seller information, a description of the goods, quantity, and total value. Make sure to include a signed and dated commercial invoice with your shipment.

If navigating the customs declaration process seems overwhelming, consider utilizing the services of a logistics partner to make the process easier on you.

Here at eShipper, we have years of experience understanding customs documentation so you can easily expand your reach with quick and effective clearance on all your outbound shipments across 220 countries.

Mastering the art of correctly filling out international shipping customs forms is a vital skill for Canadian eCommerce store owners looking to expand their market reach.

By utilizing our customs form checklist, staying informed about country-specific regulations, and avoiding common mistakes, businesses can streamline their international shipping processes and foster a positive experience for both customers and customs authorities.

And while you can do it alone, you don’t have to. Partner with us here at eShipper and get access to the cheapest international shipping rates around, as well as help navigating customs and managing cross-border logistics. Let’s make your business borderless, together.