Reem

12 mins read

10 mins read

MOHAMMAD BARAKAT

January 11, 2024

In the ever-expanding world of eCommerce, tapping into international markets is a strategic move for business growth. For US-based eCommerce store owners eyeing the thriving Canadian market, selling on Amazon.ca can be a game-changer for your business.

In this Amazon Canada selling guide, we will delve into the intricacies of cross-border eCommerce, providing insights, tips, and a step-by-step approach for your business to successfully sell on Amazon in Canada.

Before diving into the how-tos, let’s look at why international Amazon selling in Canada is a lucrative opportunity.

Amazon.ca is the country's 5th most visited website, boasting over 270 million visits in September 2023 alone. The growth of Amazon Prime accounts in Canada has been substantial, estimated to be 80% year on year.

By venturing into this market early on, US sellers position themselves to benefit from the continually expanding US$11.5 billion from 2022.

Before venturing into the Canadian marketplace on Amazon, it's crucial you understand the differences between selling in the US and Canada. Here are some considerations to keep in mind:

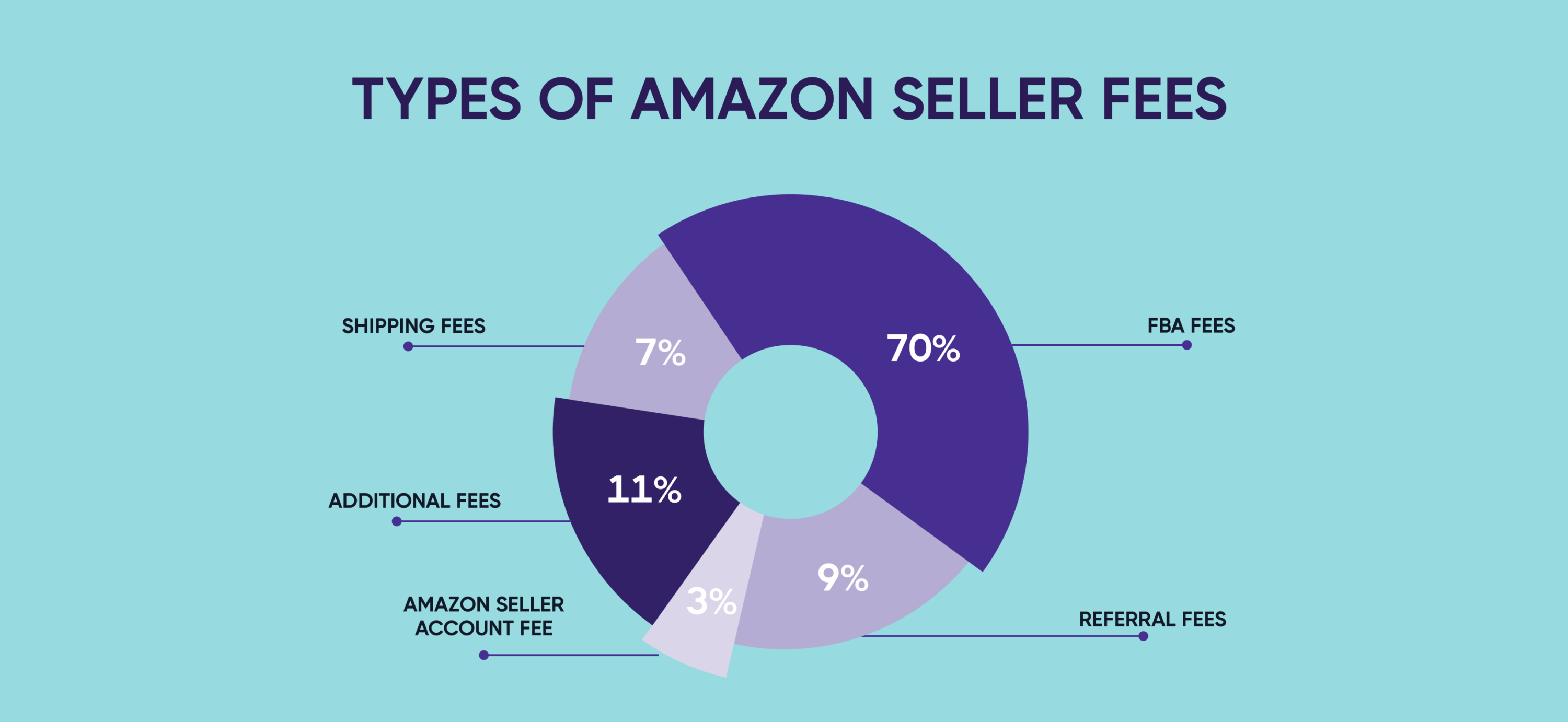

Selling on Amazon Canada comes with various fees, and understanding them is essential in order to be profitable. The primary fees include:

Referral Fees

Closing Fees

Selling Plan Fee

Advertising Fees

Fulfillment Fees

In order to make sure your move to Amazon Canada is profitable, you need to understand and plan for all these potential fees. It’s also useful to have a good grip on strategies for pricing and advertising on Amazon.ca.

Understanding the pricing dynamics and advertising costs on Amazon.ca is crucial for US sellers. Typically, products on Amazon.ca are priced higher compared to Amazon.com, which could lead to increased revenue per sale.

However, this is balanced by the fact that Pay-Per-Click (PPC) advertising costs are generally lower in Canada, offering more cost-effective marketing opportunities.

ACOS Strategy: Sellers should aim for an ACOS that is about 5-10% lower than usual, considering the interplay of higher product prices, advertising costs, and the influence of taxes and shipping on overall margins.

Beyond Amazon fees, eCommerce store owners must navigate the tax and regulatory landscape in Canada. Here are the main tax structures to be aware of:

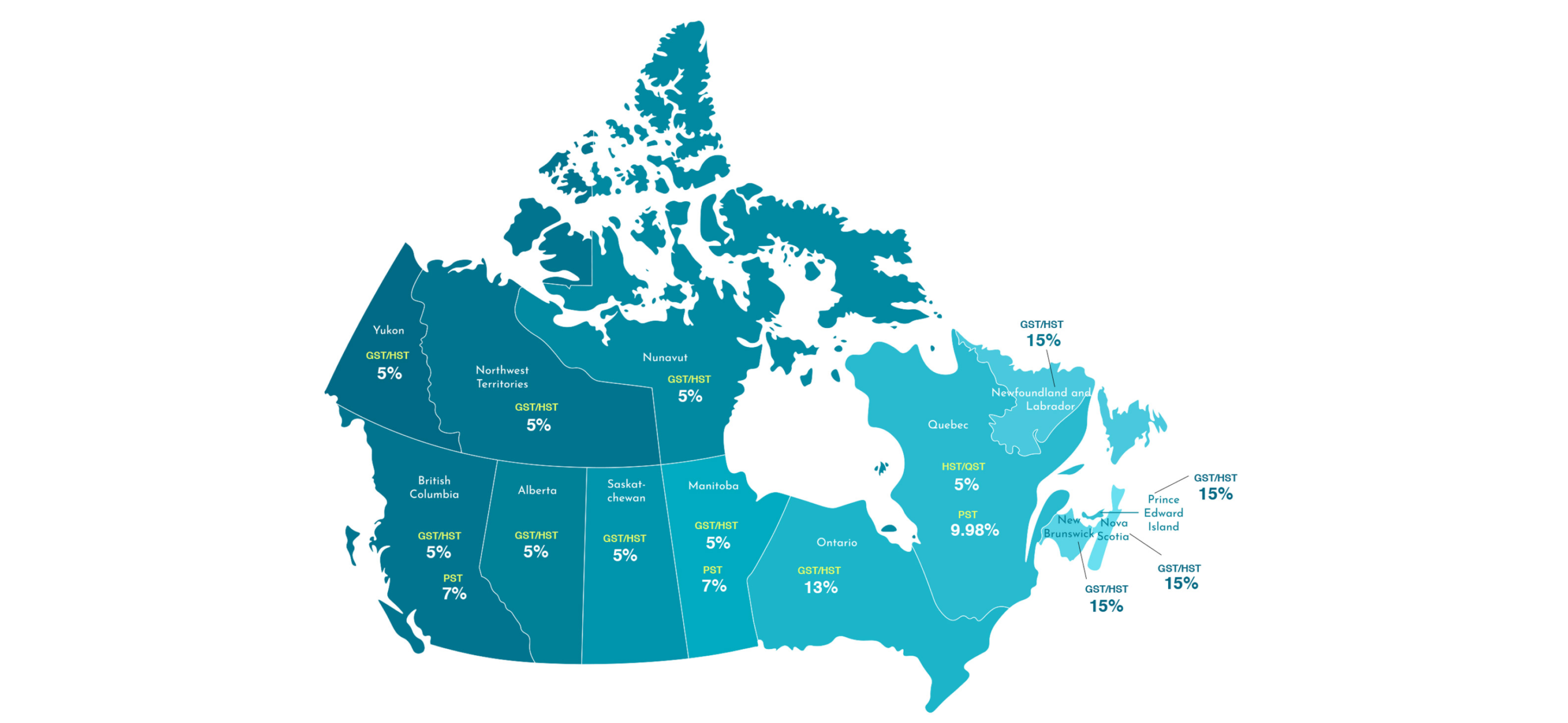

Canada imposes a Goods and Services Tax (GST) at the federal level. This is a value-added tax applied at each level in the manufacturing and marketing chain. All provinces will incur this tax, worth 5%. Four provinces/territories only charge GST; these include Alberta, Nunavut, the Northwest Territories and the Yukon.

Harmonized Sales Tax (HST)

Five provinces have fully harmonized their sales tax systems with the GST and impose a single Harmonized Sales Tax (HST), which includes the 5% GST and a provincial component. This includes Ontario (13%), New Brunswick (15%), Newfoundland (15%), Nova Scotia (15%) and Prince Edward Island (15%).

Provincial Retail Sales Tax (PST) and Quebec Sales Tax (QST)

A few provinces incur a provincial retail sales tax (PST) on top of the GST. These include British Columbia (5% GST + 7% PST), Manitoba (5% GST + 7% PST) and Saskatchewan (5% GST + 6% PST). Quebec sales tax (QST) is levied at the rate of 9.975%.

In the table below, you can see an overview of the various taxes, depending on the province. [Create table in finalized blog].

GST Only Provinces:

HST Only Provinces:

GST and PST/QST

Import Duties

Compliance with Canadian Regulations

Understanding Listing Restrictions in Canada

Navigating Canadian tax regulations can be complex, and seeking professional advice or leveraging tax management tools can help make this process much easier for you!

Here at eShipper, we have years of experience navigating international shipping between the US and Canada, and would love to help you.

Selecting the right Canada-US fulfillment method is one of your most important decisions, impacting both customer satisfaction and operational efficiency.

Fulfillment from Canada & CUSMA Commodities Benefits

When considering expansion into the Canadian market, it's vital to explore efficient fulfillment strategies. Utilizing Canada for fulfillment can significantly reduce landed costs, especially beneficial for businesses operating other online stores like Shopify or WooCommerce.

Another key aspect is the advantage of CUSMA commodities. Products manufactured in North America and classified under CUSMA are exempt from duties, offering substantial cost savings and simplifying cross-border trade.

Here are some of your available fulfillment options:

Amazon FBA in Canada

FBA Remote Fulfillment Centre

Fulfillment by Merchant (FBM)

Do I need to register my business?

Ultimately, yes.

If you’re a Canadian resident, registering your business in Canada is a fundamental step to ensure compliance with local regulations. Business registration and acquiring a business number (BN) is necessary for legal operations, tax purposes, and establishing a legitimate presence in the Canadian market.

Get started today, and create the foundation for smooth interactions with Canadian authorities and customers.

On the other hand, if you’re not a Canadian resident, you can apply for the Non Resident Importer Program (NRI), which usually takes 3-5 business days to get setup and ready!

Once you have these considerations sorted, you’re now ready to get started on your Amazon Canada journey. Let’s jump in:

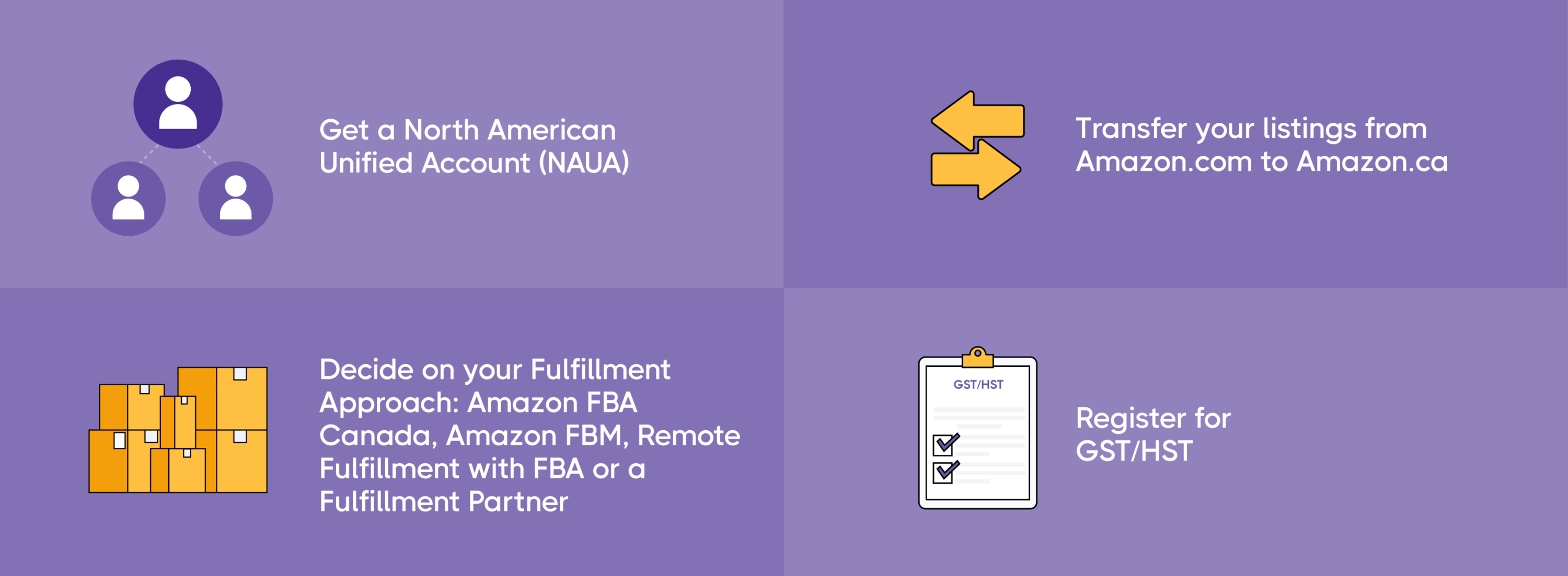

Step 1: Get a North American Unified Account (NAUA)

Initiate your journey into the Canadian Amazon market by obtaining a North American Unified Account (NAUA). This specialized account provided by Amazon facilitates seamless cross-border selling, allowing you to list and sell items across the three Amazon North American sites — the US, Canada, and Mexico.

Step 2: Transfer Your Listings From Amazon.com to Amazon.ca

Effortlessly transition your existing Amazon.com listings to the Canadian marketplace by using the built-in features in Seller Central. This ensures that your product listings are optimized for the Canadian audience and align with local market trends.

Step 3: Decide on your Fulfillment Approach: Amazon FBA Canada, Amazon FBM, Remote Fulfillment with FBA or a Fulfillment Partner

Exporting to Canada on Amazon requires a strategic approach to fulfillment. Shape your success by choosing a Canada-US fulfillment method that harmonizes with your business model and needs. We overviewed these options in the section above, namely:

Step 4: Register for GST/HST

As a responsible business owner, you must comply with Canadian tax regulations and register your business in Canada. This registration is essential for collecting and remitting taxes on your Canadian sales transactions, whether that be GST, HST or PST.

By following these steps and utilizing the resources provided by the CRA, businesses can ensure compliance with Canadian tax laws, enhancing their credibility and facilitating smooth operations in the Canadian market.

For US eCommerce businesses looking to register for the Goods and Services Tax (GST) and Harmonized Sales Tax (HST) in Canada, the Canada Revenue Agency (CRA) provides a comprehensive guide. This guide covers the essentials of GST/HST, including registration, tax collection, input tax credits, and filing returns.

Expanding your eCommerce business to Amazon Canada from the US is a strategic move in today's global marketplace.

By leveraging the Amazon North America Unified Account, understanding fulfillment methods, and adhering to Canadian regulations, you position your business for success.

So gear up, follow the steps outlined in this Amazon Canada selling guide and allow us here at eShipper to help you with all of your shipping needs so we can embark on your journey to conquer the Canadian eCommerce landscape.